Millions of fixed-rate mortgages are ending. Discover 6 practical steps you can take now

February 02, 2023

Over the last year, interest rates have increased from historic lows. Fixed-rate mortgage payers that have been shielded from the rises so far could find their outgoings rise if their deal ends in 2023.

The Bank of England increased its base interest rate several times over the last 12 months to tackle high levels of inflation.

For savers, it’s been good news, as interest rates on savings accounts have started to rise after more than a decade of being low.

However, for borrowers, it means the cost of debt has climbed. From credit cards to loans, the amount you pay to service debt has probably increased. As a mortgage is often one of the largest loans you’ll take out, even a small change to the interest rate could affect you.

57% of fixed-rate mortgages ending have an interest rate below 2%

Data from the Office for National Statistics suggests that 1.4 million households will need to renew their mortgage deal this year.

Among the fixed-rate deals coming to an end, 57% have an interest rate below 2%. It’s unlikely you’ll find a new mortgage deal that has an interest rate this low. So, monthly repayments could rise for thousands of households over 2023.

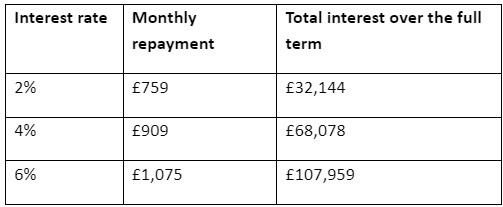

Let’s say your remaining mortgage debt is £150,000. If you choose a 20-year repayment mortgage, the table below shows how an increase of just a few per cent could affect the cost of borrowing.

Source: MoneySavingExpert

If your mortgage deal is ending, being proactive can help you prepare for the potentially higher costs and get to grips with your budget.

6 practical things you should do if your fixed-rate mortgage ends in 2023

1. Review your budget

Take some time to understand what rising interest rates will mean for you. Being prepared means the hike in your mortgage outgoings won’t be unexpected.

2. Decide if taking out a new mortgage deal is right for you

While it can be tempting not to take out a new mortgage deal if there’s nothing comparable to your current one, you could end up paying more.

Once your current deal ends, you’ll usually be moved on to your lender’s standard variable rate (SVR). This rate isn’t usually competitive, and you could save money by taking out a new deal.

However, there are some circumstances when remaining on your lender’s SVR does make sense. For instance, if you plan to move, you could face exit fees if you choose to take out a new deal. Or, if you want to make significant overpayments, remaining on the SVR could mean you avoid fees.

3. Decide what kind of mortgage is right for you

Do you want to take out another fixed-rate mortgage? Or would a variable- or tracker-rate mortgage suit you now?

Interest rates may continue to rise over 2023. So, you may choose a fixed-rate deal again. This would mean that your repayments could not increase during the term. However, if interest rates began to fall, you wouldn’t benefit.

In contrast, with a variable- or tracker-rate mortgage, the interest rate could rise and fall.

Which is right for you will depend on your financial circumstances and priorities. If you want certainty, a fixed-rate deal can be useful, but you should review all your options.

4. Set out the mortgage term and how much you want to borrow

Usually, each time you remortgage, the term and amount you borrow falls. However, this doesn’t have to be the case.

You may choose to shorten or extend how long you’ll be paying the mortgage. If you shorten the term, your repayments will be higher, but you could be mortgage-free sooner and pay less interest overall. If the cost of living crisis means your budget will be stretched, choosing a longer term could provide more flexibility and lower initial repayments but will mean the overall cost of borrowing is higher.

You may also choose to borrow more. You could use this money to renovate your home or pay for other expenses. Again, keep in mind that borrowing more against your home will mean paying more in interest, and it’ll affect your repayments.

5. Search for deals early

You can often lock in a new mortgage deal up to six months before your current one ends.

Searching early means you can avoid paying your lender’s SVR while you find a new deal and it gives you more time to find a suitable option for you.

6. Contact us

We’re here to help you find a mortgage that suits your needs. If your current deal is coming to an end, please get in touch. We can help you understand which type of mortgage could be right for you and how the rising interest rates will affect your repayments.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.