Interest rate rises lead to fewer mortgage deals on the market

May 12, 2022

First-time buyers and homeowners searching for a new mortgage deal are finding there’s less choice on offer.

Following the Bank of England (BoE) increasing the base interest rate three times since the start of the year, providers have pulled some deals from the market and increased rates. It means it could be more difficult to find a competitive mortgage that’s right for you.

The BoE’s base rate has been low since the 2008 financial crisis and was cut to 0.1% during the Covid-19 pandemic to support the economy. Now, as inflation rises, the rate is slowly being increased. In February, the rate was increased to 0.5% and then again in March to 0.75%. As of May, the interest rate is 1%.

While the rise is relatively small, it can affect the cost of borrowing. When you’re taking out a large sum to purchase a home, even a seemingly small rise can add up to thousands of pounds. In addition, banks are pulling some mortgage deals in anticipation of further rises.

More than 500 mortgage deals were removed in February

At the start of March 2022, there were 518 fewer mortgage deals when compared to just a month earlier, according to Moneyfacts UK statistics.

The choice of mortgages shrunk at the sharpest pace since the beginning of the Covid-19 pandemic in May 2020 and marks the second consecutive month that the number of available mortgages has fallen.

While there are still thousands of mortgage deals to choose from, less choice can mean it’s more difficult to find a deal that suits your needs. This is particularly true if you need some flexibility or you need to approach a specialist lender, for example, because you’re self-employed or your credit rating is poor.

The research also suggests that, on average, a mortgage deal has a shelf life of just 28 days. If you’ve received a mortgage offer, it will usually be valid for three to six months.

For some, it can mean that you find a mortgage deal that’s right, only to find that it’s no longer available when you’re ready to apply.

If you’re searching for a home or facing delays in the buying process, a short shelf life can be frustrating. If you need to reapply for a mortgage, you may find the initial deal you received an offer for is no longer an option.

Interest rates are beginning to creep up and it could mean your repayments rise

After two BoE base rate rises this year, it’s not surprising that lenders are increasing their interest rates too.

According to the data, an average two-year fixed-rate mortgage across all loan-to-value ratios (LTV) had an interest rate of 2.65% in March compared to 2.44% in February. If you wanted to fix your interest rate for five years, it would increase to 2.88%.

A tracker-rate mortgage means the interest rate you pay tracks the BoE’s base rate. As a result, it can rise and fall during your mortgage term. If you wanted to take out a two-year tracker-rate mortgage, the average interest rate in March was 2.03% compared to 1.7% just a month earlier.

These changes can seem insignificant when you look at how much your mortgage costs. Yet, it can affect your regular outgoings and means the total cost of borrowing is far higher over the full mortgage term.

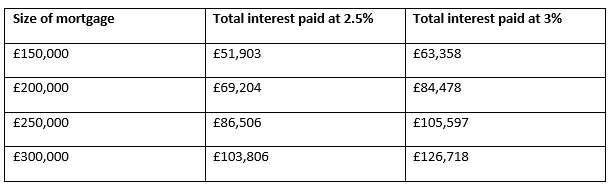

The below table shows how a 0.5% difference in interest rate can affect the cost of borrowing over a 25-year term for a repayment mortgage, assuming the interest rate stays the same.

Not securing a competitive mortgage, even if the interest rate only seems marginally different, could cost you thousands of pounds.

You should consider the interest rate if your mortgage deal has come to an end too.

Once your deal has come to an end, you will usually be moved on to your lender’s standard variable rate (SVR). In March, across all LTVs, the average SVR was 4.61% after a month-on-month rise from 4.46%.

Not taking out a new mortgage deal can provide you with more flexibility. However, an SVR is usually not competitive, and you are likely to save money by searching for a new deal.

Despite this, 42% of people didn’t switch their mortgage when their deal ended during the pandemic, according to an FTAdviser report. That’s the equivalent of 2.9 million people potentially paying a higher interest rate than they need to.

How working with a mortgage broker could help you

When asked why they hadn’t taken out a new mortgage deal, 21% said the process was too time-consuming or difficult.

Working with a mortgage broker can make the process of finding a new mortgage deal easier. A broker can search the mortgage market for you, including lenders that don’t have a high street presence, to find a deal that suits your needs. It can save you time and, over the length of the mortgage, money.

If you’d like to talk to one of our team about your mortgage needs, please contact us.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.