Do you think financial protection claims aren’t upheld? 98% were paid in 2021

May 05, 2024

If you think that insurers don’t pay out when people make claims, you’re far from alone.

According to Scottish Widows, just 7% of people think that life cover claims pay out between 91% and 100% of the time.

For critical illness claims, this figure falls dramatically to just 2%.

Together, these figures show the lack of confidence many people have in insurers to pay out when claims are made.

In reality, however, this perception is far from accurate. So, find out the true figures behind financial protection claims, and why keeping your cover in place is important, especially as the cost of living soars in the UK.

98% of claims made in 2021 were upheld

Data from the Association of British Insurers (ABI) shows that 98% of claims made in 2021 were upheld, with insurers paying out a record £6.8 billion in individual and group life insurance, income protection, and critical illness claims.

This translates to £18.6 million paid out every single day, £1.6 million more than in 2020 when the previous record was set.

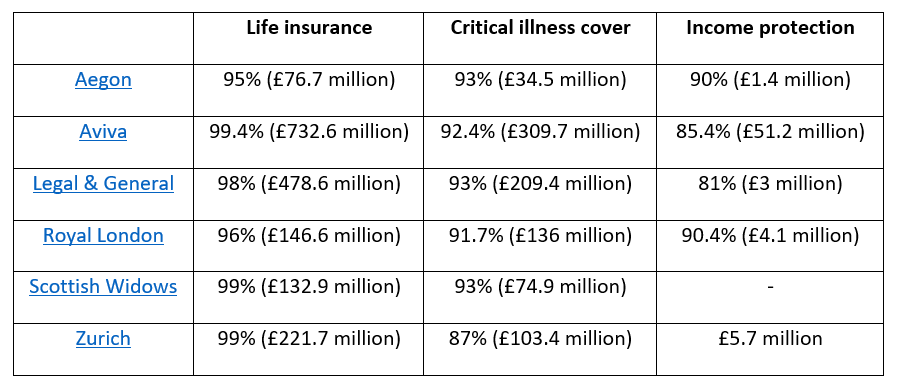

The table below shows a breakdown of these figures for six of the largest insurers in the UK:

As you can see, the number of paid claims is typically in the 90s, and doesn’t drop below 80% in any of these examples. That means the perception that insurers don’t pay out isn’t accurate at all.

What protection do these types of cover offer?

Now you know that insurers will pay out in the majority of claims, it’s also useful to understand what you receive from these three types of cover.

Find out more about life insurance, critical illness cover, and income protection below.

Life insurance

Life insurance pays out a lump sum to your chosen beneficiaries if you die while the cover is in place.

There are different types of life insurance, two of the most common being:

- Term life insurance, in which your cover lasts for a set number of years and then expires if not renewed

- Whole life insurance, a type of cover that does not expire.

Your chosen beneficiaries of your lump sum are then free to use the money as they wish, including paying household bills and mortgage repayments.

According to the ABI, the average value of a life insurance payout was £80,485 in 2021.

Critical illness cover

Critical illness cover provides you with a lump sum payout in the event that you’re diagnosed with a critical illness or have major surgery that’s covered on the policy.

Illnesses and surgeries covered by critical illness cover can include:

- Heart attack

- Stroke

- Many types of cancer

- Kidney and liver failure

- Open-heart surgery.

In this event, you’ll receive a lump sum payout and your cover will end. This lump sum can be instrumental in helping you to provide for your family at a difficult time, especially if your condition is particularly serious or even terminal.

The ABI recorded the average value of claims paid to be £67,951 in 2021.

Income protection

Income protection offers you a regular income if you’re unable to work due to sickness or disability. The cover will continue until the term of the policy ends, you’re able to return to work or you retire.

Typically, you’ll receive around two-thirds of your current income from your cover. This income is tax-free, meaning it should be almost akin to your take-home pay.

This can be a significant lifeline if you’re suddenly unable to work, ensuring that you can continue to provide for your family.

The average value of claims paid was £23,380 in 2021, according to the ABI.

Financial protection is even more important in the current climate

With the cost of living on the rise and the need to tighten your belt seemingly a high priority, cancelling financial protection you have may seem like a sensible way to reduce your expenses.

However, this may actually be a mistake, especially during periods of uncertainty like this.

You never know what’s going to happen next, and so having protection in place offers you and your family financial security.

Imagine that you were to be diagnosed with a critical illness or become disabled in such a way that you were unable to work. This could put your family in a difficult position where you suddenly couldn’t afford to pay your bills or your mortgage repayments.

By having protection in place, you’ll be financially covered if one these events occurs, providing a valuable lifeline that ensures your family are able to continue living your lifestyle with as little disruption as possible.

At the very least, you’ll have the reassurance that you’re covered amid the uncertainty that we face right now.

Get in touch

Do you want to find out more about the financial protection options available? Get in touch with us today.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Note that life insurance plans typically have no cash in value at any time and cover will cease at the end of the term. If premiums stop, then cover will lapse.