Fiscal drag: How threshold and allowance freezes affect you

January 02, 2025

Despite intense speculation that the Labour government would slash tax allowances and exemptions, many are set to remain the same in the 2025/26 tax year. While that might seem like something to celebrate, fiscal drag could mean your tax liability increases in real terms.

To maintain allowances and exemptions in real terms, the government would need to increase them by the rate of inflation.

So, when they are frozen instead, your taxable income is likely to increase as you might be “dragged” into paying tax or paying tax at a higher rate. This generates higher revenues for the government without increasing tax rates. For this reason, freezes are sometimes called “stealth taxes”.

Several tax thresholds have been frozen since April 2022 and aren’t expected to rise until April 2028. When you consider the period of high inflation experienced recently, the effect of fiscal drag could mean you’ve paid a significantly higher proportion of tax, relative to your income, than you did previously.

Income Tax: Thresholds are frozen until April 2028

The previous Conservative government froze Income Tax thresholds in 2022 until April 2028. The current Labour government has said it will continue the freeze.

During the freeze, it’s likely that your income will rise, which would maintain your spending power. However, as the thresholds will not increase, your tax liability might also rise. It may seem like a small increase initially, but it can add up over the years.

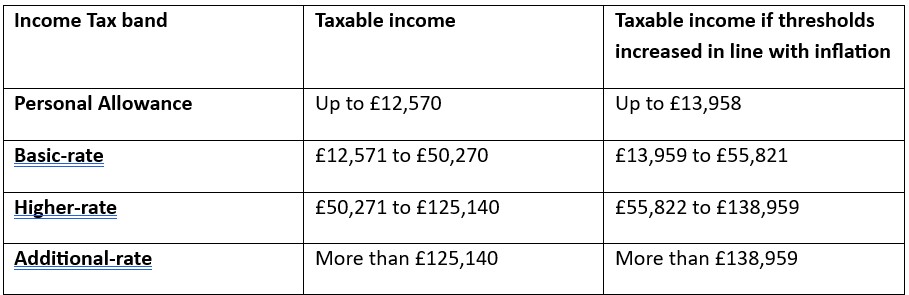

The table below shows how the value of Income Tax thresholds would have changed if they had increased in line with inflation between January 2022 and November 2024.

Source: Bank of England

With the freeze expected to remain in place for another three years, the effects of fiscal drag will become more evident.

According to the Office of Budget Responsibility (OBR), freezing Income Tax thresholds mean that between 2022/23 and 2028/29, an extra 4 million people will pay Income Tax. In addition, 3 million will be dragged into the higher-rate tax band and 400,000 will pay the additional-rate of Income Tax for the first time.

The fiscal drag is estimated to raise £42.9 billion in tax by 2027/28.

The OBR noted frozen thresholds are the largest contributor to the rising overall economy-wide tax burden. The freeze will be responsible for almost a third of the 4.5% GDP increase in taxes from 2019/20 to 2028/29.

Freezes to Inheritance Tax thresholds and ISA limits could affect your finances too

It’s not just freezes to Income Tax you may need to be mindful of either. Frozen allowances include the:

- Inheritance Tax thresholds: The nil-rate band is frozen at £325,000 – it has been at this level since 2009/10 and will remain the same until April 2028. The residence nil-rate band last increased to £175,000 in 2020/21 and is also frozen until the start of the 2028/29 tax year.

- ISA allowance: The amount you can add to your ISA each tax year is frozen at £20,000 for adults and £9,000 for children until 5 April 2030. The amount you can pay into an adult ISA hasn’t increased since 2018/19, and the Junior ISA subscription limit last increased in 2020/21.

There are other allowances and exemptions that, while not frozen, haven’t increased in line with inflation either.

For example, the amount you can gift in a tax year that will be immediately outside of your estate for Inheritance Tax purposes is known as the “annual exemption”. In 2024/25, the annual exemption is £3,000 and it’s been at this level since 1981.

If the annual exemption had increased in line with inflation between 1981 and November 2024, it’d stand at £11,314.

A financial plan could help you minimise the effects of fiscal drag

While you can’t change tax thresholds or allowances, there might be steps you can incorporate into your financial plan to reduce your overall tax bill.

For instance, increasing your pension contributions could reduce your taxable income and mean you avoid being dragged into a higher Income Tax bracket. While it may mean your take-home pay is lower, it could support long-term retirement goals and may be right for you as a result.

In addition, while the ISA allowance is frozen, if you’re not already depositing the full amount, increasing how much you add to your ISA may reduce your Income Tax bill.

Interest earned on savings that aren’t held in a tax-efficient wrapper, like an ISA, could become liable for Income Tax if they exceed your Personal Savings Allowance (PSA). The PSA is £1,000 if you’re a basic-rate taxpayer, £500 if you’re a higher-rate taxpayer, and £0 if you’re an additional-rate taxpayer.

If you’d like to talk about how fiscal drag may affect your finances and the steps you might take to mitigate the effects, please get in touch.

Please note:

This blog is for general information only and does not constitute financial advice, which should be based on your individual circumstances. The information is aimed at retail clients only.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.